AGRICULTURAL PRODUCTS

IMPORT AND

EXPORT

農産品輸出入

We handle all operations related to the import and export of agricultural products, including fruit and vegetables. We go beyond processing paperwork for exports to provide integrated logistics outsourcing for everything including cargo handling at ports, container shipping, storage in temperature-controlled warehouses, and arranging ships.

-

Import of Agricultural Products

We handle customs clearance procedures and arrange transportation from the port to our warehouse or to the customer's designated destination.

-

Export of Agricultural Products

We help with the export of apples from Aomori Prefecture and other produce. We provide not only domestic logistics but integrated services for everything from arranging ships and providing insurance to making domestic quarantine arrangements.

-

General Sundries

We accept all types of cargo, including those that require room temperature storage, refrigeration, and special cargo. Please feel free to contact us about anything.

Feel free to contact us here for consultations and inquiries

CUSTOMS

CLEARANCE

通関

We handle all procedures, declarations, applications, and other matters related to customs clearance required by government agencies when trading with foreign nations. For everything from ship and aircraft arrangements to import and export in bonded areas and customs declarations, applications, inspection and distribution, leave it to us.

Customs Clearance Services

Customs clearance services refers to declarations and other tasks required by customs agencies when trading with foreign nations.

-

#1 Custom Clearance Procedures

All procedures from export, reloading, or import declaration to obtaining the requisite permits

All procedures from applying for approval of a special importer to obtaining that approval

All procedures from applying for approval of a special exporter to obtaining that approval

All procedures from declarations of loading of goods for ships or aircraft to obtaining that approval

All procedures from applications to place foreign cargo in a bonded warehouse, bonded factory, or general bonded area to obtaining that approval -

#2 Customs Act

The Customs Act is a law stipulating the processes for determining, paying, collecting, and refunding of customs duties as well as customs procedures for import and export of goods, which must be complied with during customs clearance. Penalties for violating this law include imprisonment and fines. We fully understand the Customs Act as we carry out customs clearance procedures.

-

#3 Customs Act Claims

In the event of an unsatisfactory investigation, inspection, or disposition despite the fact that customs clearance procedures have been carried out in accordance with the Customs Act, an appeal can be filed with the tax office to contest the disposition.

Since we are a licensed customs broker, we can create documents for customs clearance and carry out customs clearance procedures in compliance with the Customs Act.

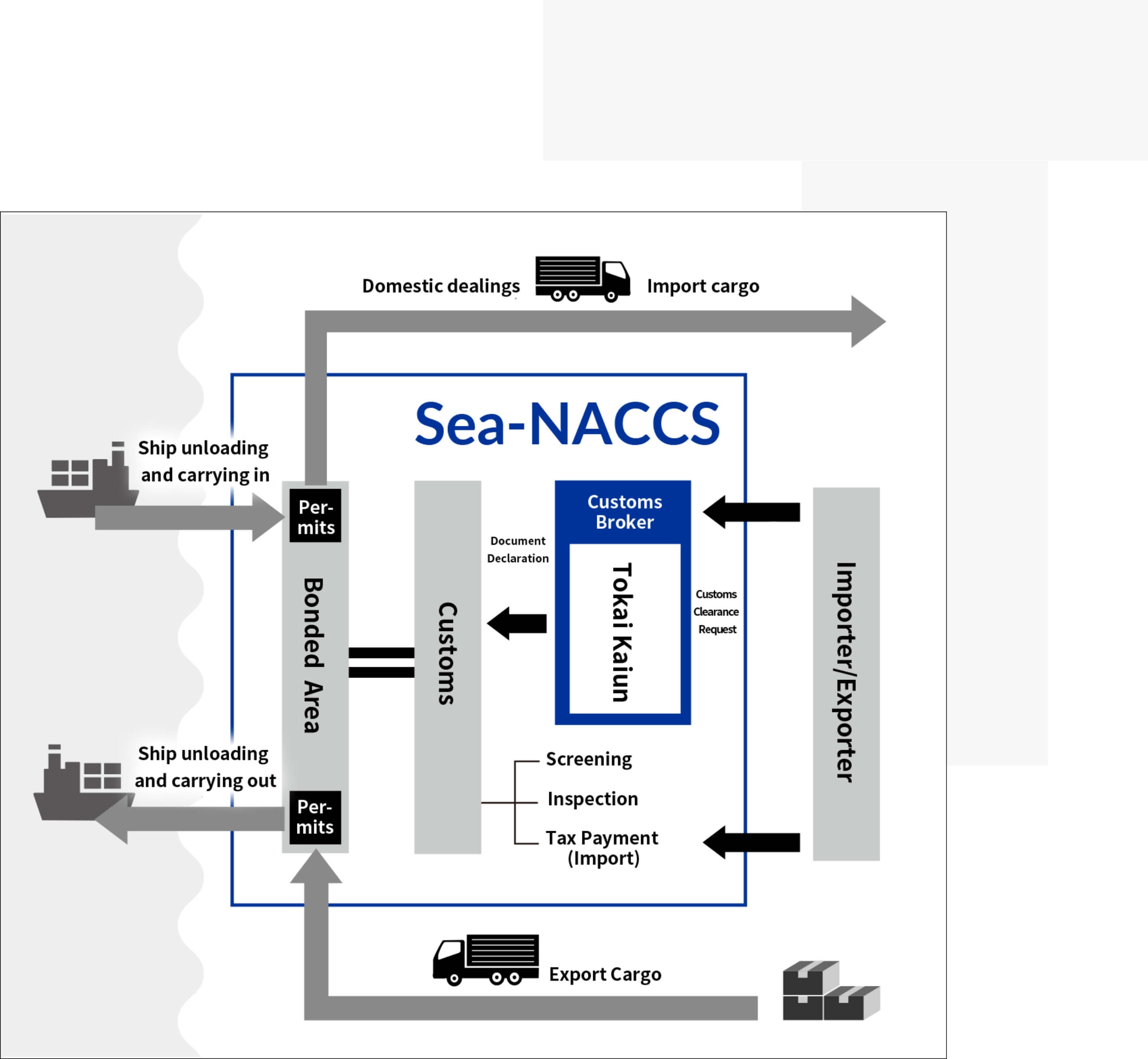

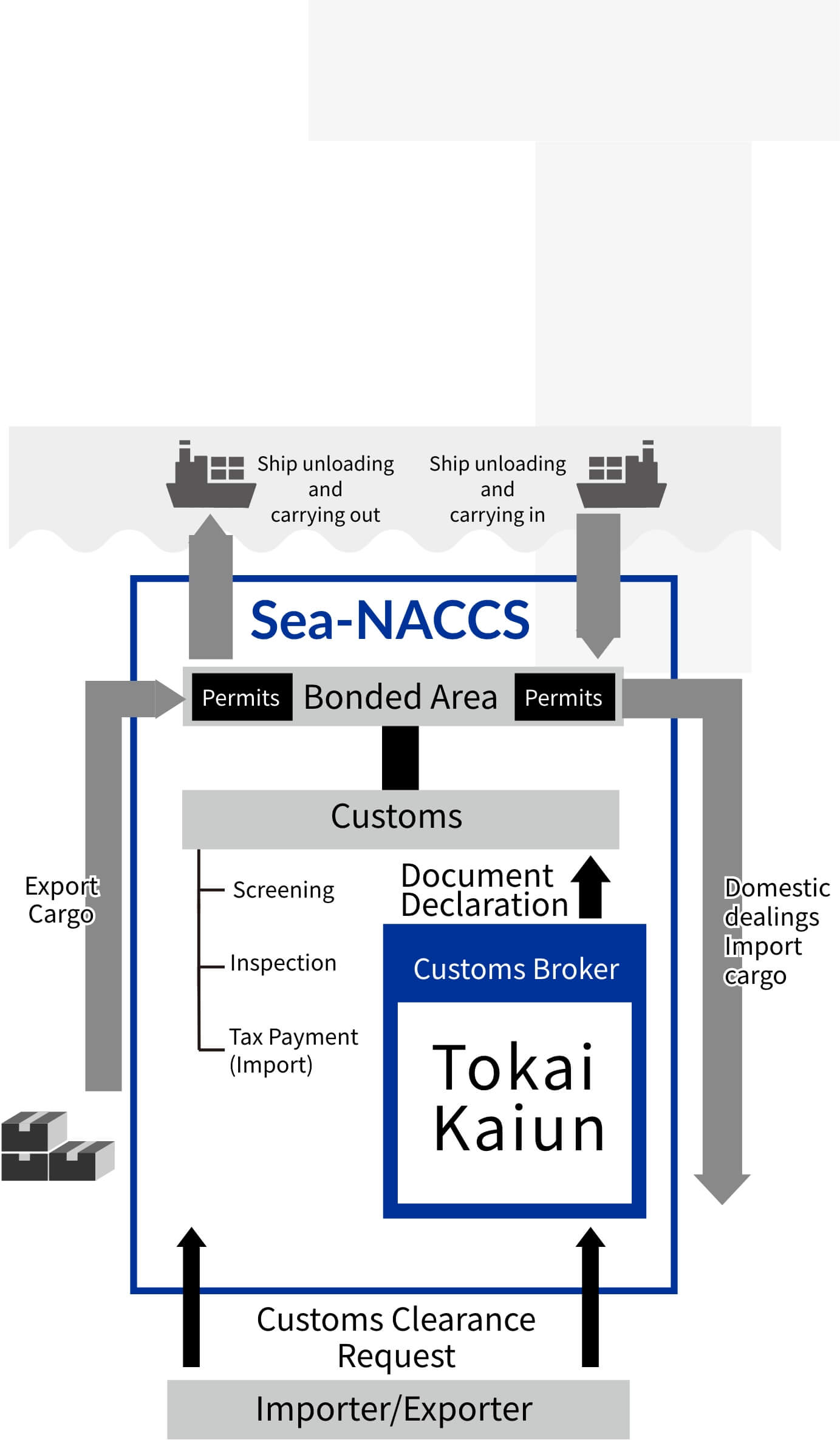

Export Clearance Process

Lading reservation → Approval and confirmation of other laws and regulations → Export clearance → Export license → Lading

-

#1 Ship & Aircraft Arrangements

The export cargo is loaded into the bonded warehouse. An export declaration is made to the tax office with jurisdiction over the bonded warehouse where the cargo has been loaded.

For this export declaration, an export declaration form, invoice, and other legal documents are submitted to customs. After the documents are examined at customs, an investigation is performed as needed, then an export license is issued.

The cargo is removed from the bonded warehouse and loaded onto ships and aircraft.

An export declaration is made by submitting an Export Declaration Form with the required items filled in to the chief of customs; however, the following documents, if applicable, need to be attached to the Export Declaration Form. -

#2 Legal Permits and Approval

Specified documents required for export declarations related to duty reduction, exemption, or refunds as stipulated in the Customs Tariff Act and other laws

Export certificate application for export exempt cargo and export cargo exempt from domestic consumption tax (excluding local consumption tax), or an export declaration appendix

In addition, when exporting goods subject to permits, approval, and other export restrictions under laws and regulations other than the Customs Act, the relevant permits and approvals must be submitted when making a declaration to Customs. -

#3 Application Procedures

A customs broker determines cargo category and duty rate, creates customs documents, checks that the content of a declaration form (currency used, Incoterms, destination, place of origin, etc.) is the same as on the invoice, verifies the applicability of trade control regulations and other regulations as well as checks the required documents, classifies the cargo in order to assign an HS code (statistical item number), then arranges any other documents required for the declaration or permit.

Import Clearance Process

Acquisition of lading documents → approval/verification of other laws/regulations → import customs clearance → Taxed import permit → domestic dealing

-

#1 Import

Submit an import (tax) declaration form with the necessary documents to the customs office to make an import declaration.

Customs will examine the declaration documents and inspect them if necessary.

After the importer pays duties, consumption tax, etc., an import permit is issued.

The importer picks up the imported cargo from a bonded area and distributes them as domestic goods.

As a general rule, import declarations are made after cargo has been delivered to a bonded area. -

#2 Legal Permits and Approval

During inspections at customs, rather than having an officer look at the actual cargo with the naked eye, the entire container is run through a giant X-ray, and if there are no problems, permission is granted. If there is even a small problem, then the actual item will be opened and checked. Import declarations are made by going to the ship company, obtaining documents related to shipping contracts, then submitting the invoice and other documents sent by the exporter along with the declaration form to the customs office that has jurisdiction over the bonded area where the cargo is being stored. Payment of customs duties is required to obtain an import permit, and the taxed amount is calculated as the duty x CIF value for imports.

-

#3 Required Documents

The following documents, if applicable, are required.

1.Arrival Notice

2.Insurance Policy

3.Certificate of Origin

4.Permits/Approval Certificates from Authorities

After declaring imports and paying duties, and after passing any applicable laws or regulations, an import permit is granted. However, there may be restrictions under domestic laws depending on the item being imported, so sufficient research is required in advance.

SeaNACCS

We use SeaNACCS to ensure smooth and speedy customs declaration processes.

Efficient management of the entire process from port to warehouse, then to customs, distribution, and logistics allows us to significantly reduce costs. Feel free to contact us.

SeaNACCS Business Flow

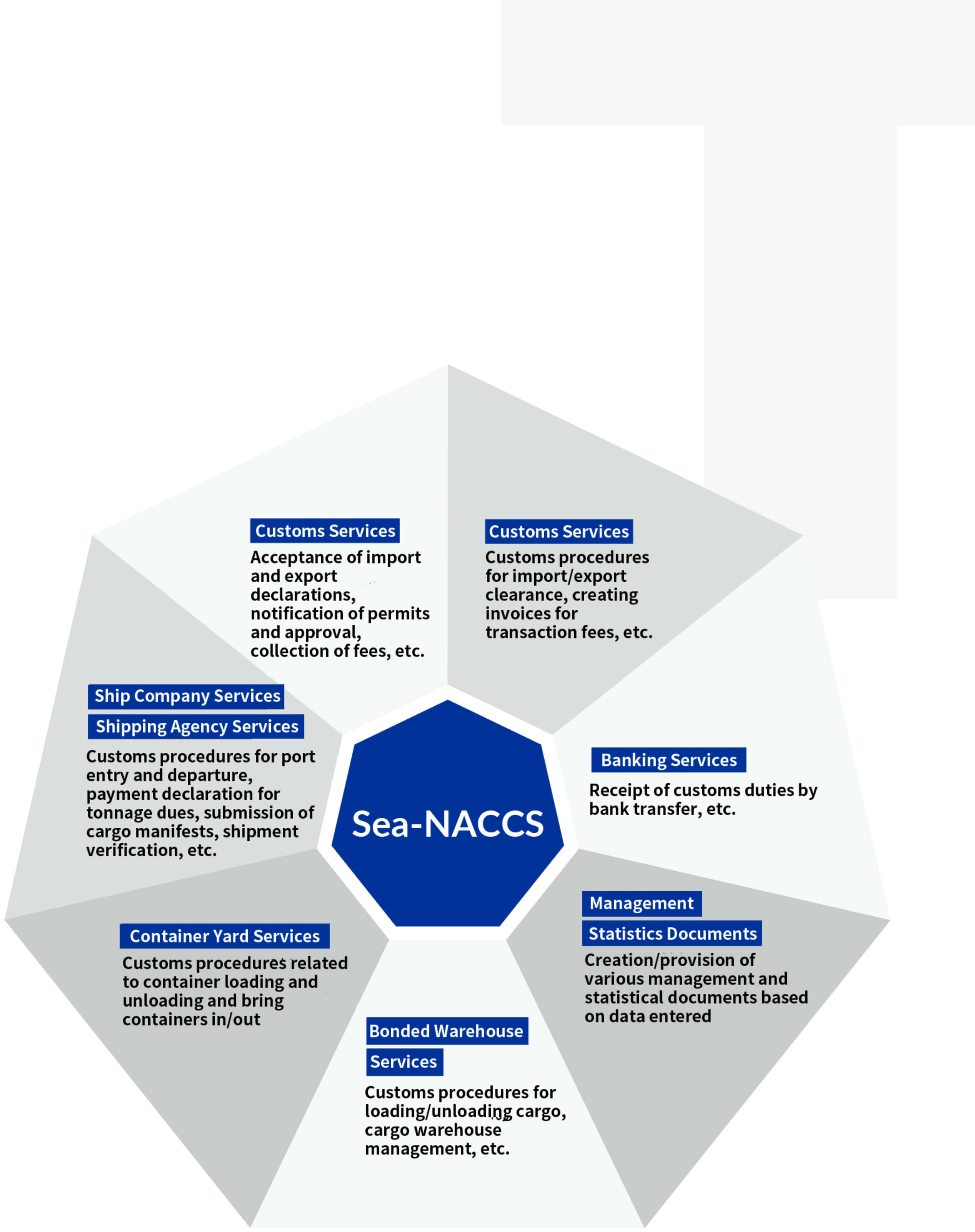

Customs Clearance Services by SeaNACCS

Short for Nippon Automated Cargo Clearance System, SeaNACCS is a system launched to handle customs procedures for international freight cargo and other tasks related to international cargo in a timely and accurate manner.

The NACCS Center (Customs Information Processing Center) host computer is connected via internet to devices at customs, customs brokers, ship companies, and other user offices, allowing us to perform all import, export, and port-related procedures for relevant agencies and organizations by entering and sending data just once, meaning we are able to perform customs clearance procedures extremely fast.

Customs Services

Acceptance of import and export declarations,

notification of permits and approval,

collection of fees, etc.

Customs Services

Customs procedures for import/export clearance,

creating invoices for transaction fees, etc.

Banking Services

Receipt of customs duties by bank transfer, etc.

Sea-NACCS

Management Statistics Documents

Creation/provision of various management

and statistical documents based on data entered

Bonded Warehouse Services

Customs procedures for loading/unloading cargo,

cargo warehouse management, etc.

Container Yard Services

Customs procedures related to container loading

and unloading

and bring containers in/out

Ship Company Services・Shipping Agency Services

Customs procedures for port entry and departure,

payment declaration for tonnage dues,

submission of cargo manifests, shipment verification, etc.

Feel free to contact us here for consultations and inquiries